ITA is an incentive granted based on the capital expenditure incurred on industrial buildings plant and. ABC Sdn Bhd was incorporated in early.

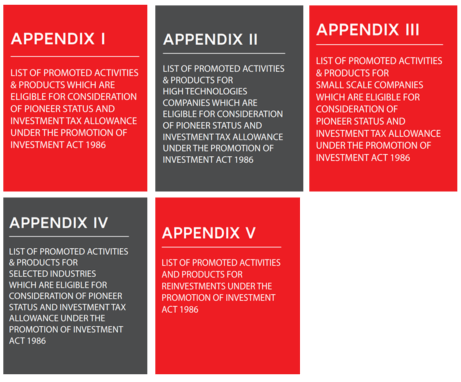

Promoted Activities Mida Malaysian Investment Development Authority

PIONEER STATUS INVESTMENT TAX.

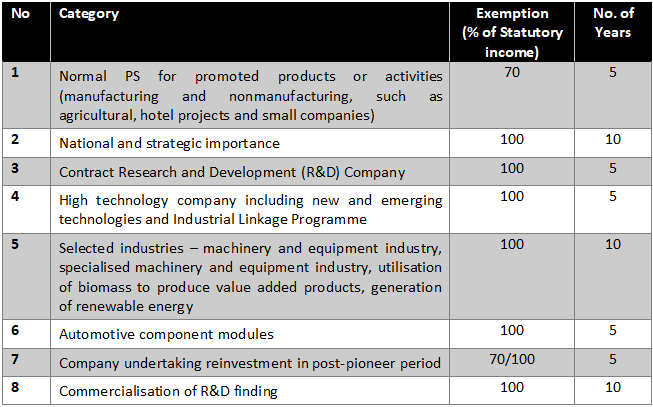

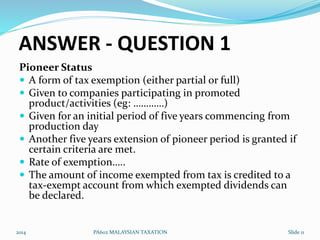

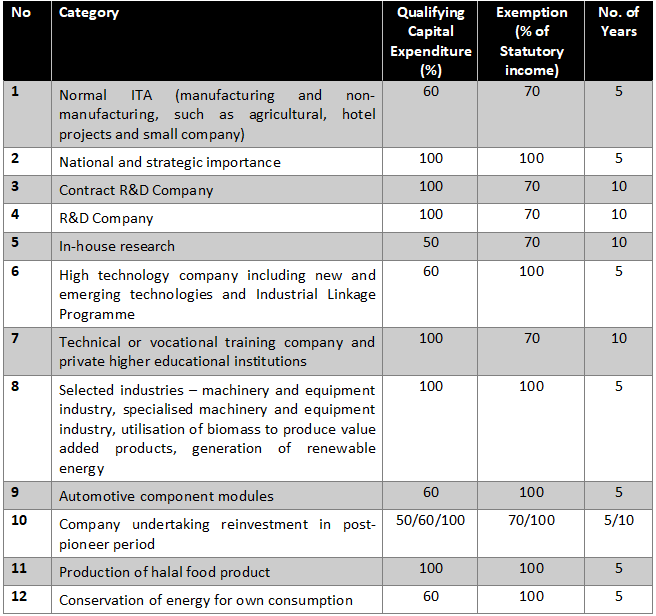

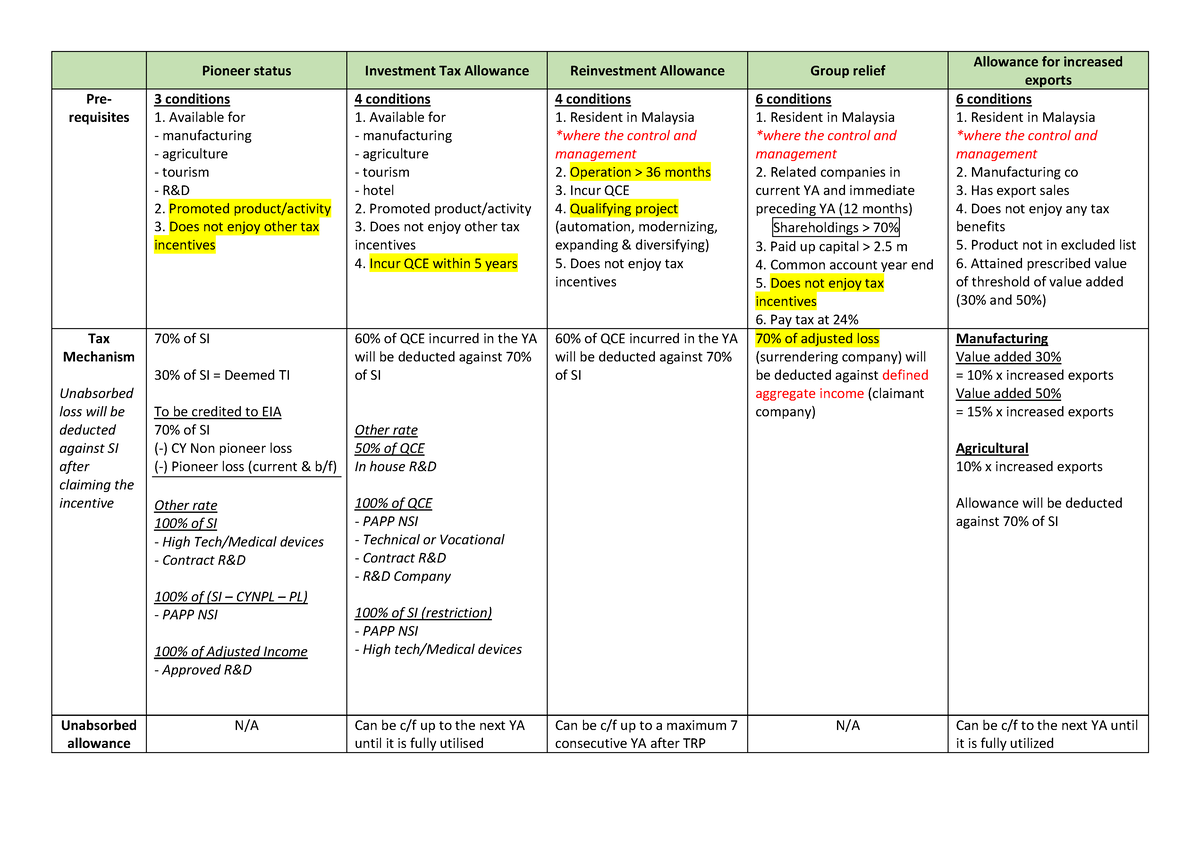

. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for Investment. Compute the amount of unabsorbed pioneer business losses available to carry forward at the end of the tax relief period. While reading this article candidates are expected.

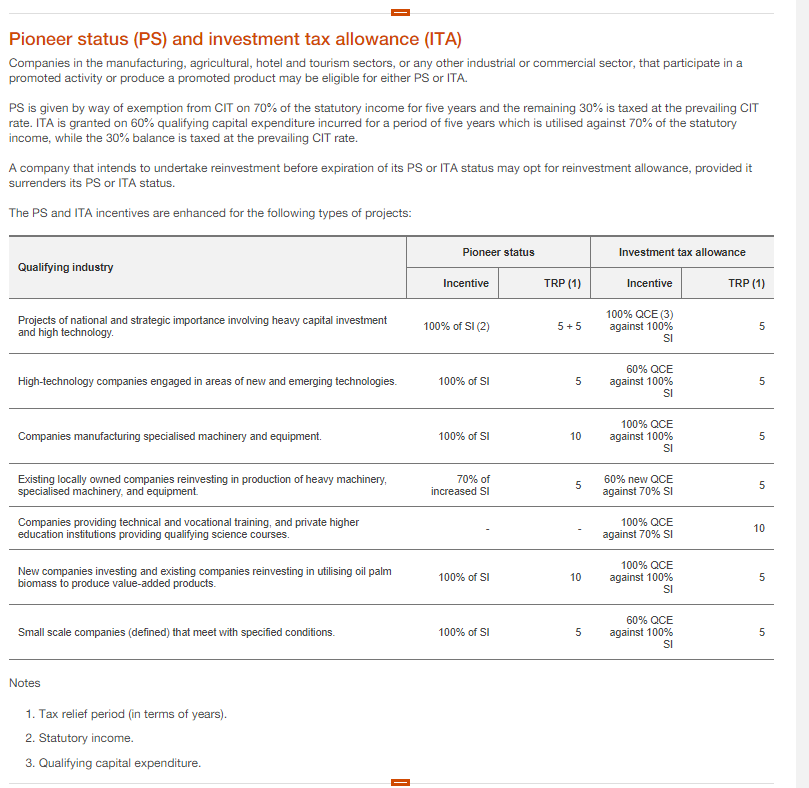

Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. Ad Open a Brokerage Account to Gain Free Access to Courses on Stocks Bonds More. The major tax incentives for companies investing in the manufacturing sector are the Pioneer Status and the Investment Tax Allowance.

Eligibility for Pioneer Status and Investment Tax. The alternative to pioneer status incentive is usually the investment tax allowance ITA. This article collates and discusses the provisions in the Income Tax Act 1967 the Act and the Promotion of Investments Act 1986 PIA.

Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. View PIONEER STATUS INVESTMENT TAX ALLOWANCEpptx from FPEP BT1203 at University Malaysia Sabah Labuan International Campus. Then discuss your retirement journey with your Ameriprise financial advisor.

A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a. Promotions of Investments Act 1986 - Investment Tax Allowance. Ad Get started and take the 3-Minute Confident Retirement check to start finding answers.

Ad Holistic approaches to wealth management including tax planning and goal setting. Pioneer status often provides a 70 exemption of statutory income for a period of 5. Pioneer status often provides a 70 exemption of statutory income for a period of 5.

Application for pioneer status received on or after 1111991. Tax exemption restricted to 70 of statutory income for 5 years. Pioneer status PS and investment tax allowance ITA Companies in the manufacturing agricultural hotel and tourism sectors or any other industrial or commercial sector that.

Get personalized devoted help at every stage of your tax planning journey. Similar lists of promoted products or activities as applied for pioneer status would also be applied for ITA. No extension of tax relief period for a further 5 years.

Investment Opportunities In Malaysia 25 June Ppt Download

Atx Mys Pioneer Status Part 2 Atx Mys Pioneer Status Part 2 Acca Lyceum Is An Innovative Collaboration Between Acca Malaysia And Malaysia S Platinum Alps Bringing To You Effective By Acca Facebook

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Chapter 5 Investment Incentives

Solved 1 Cekap Sdn Bhd A Malaysian Resident Company Chegg Com

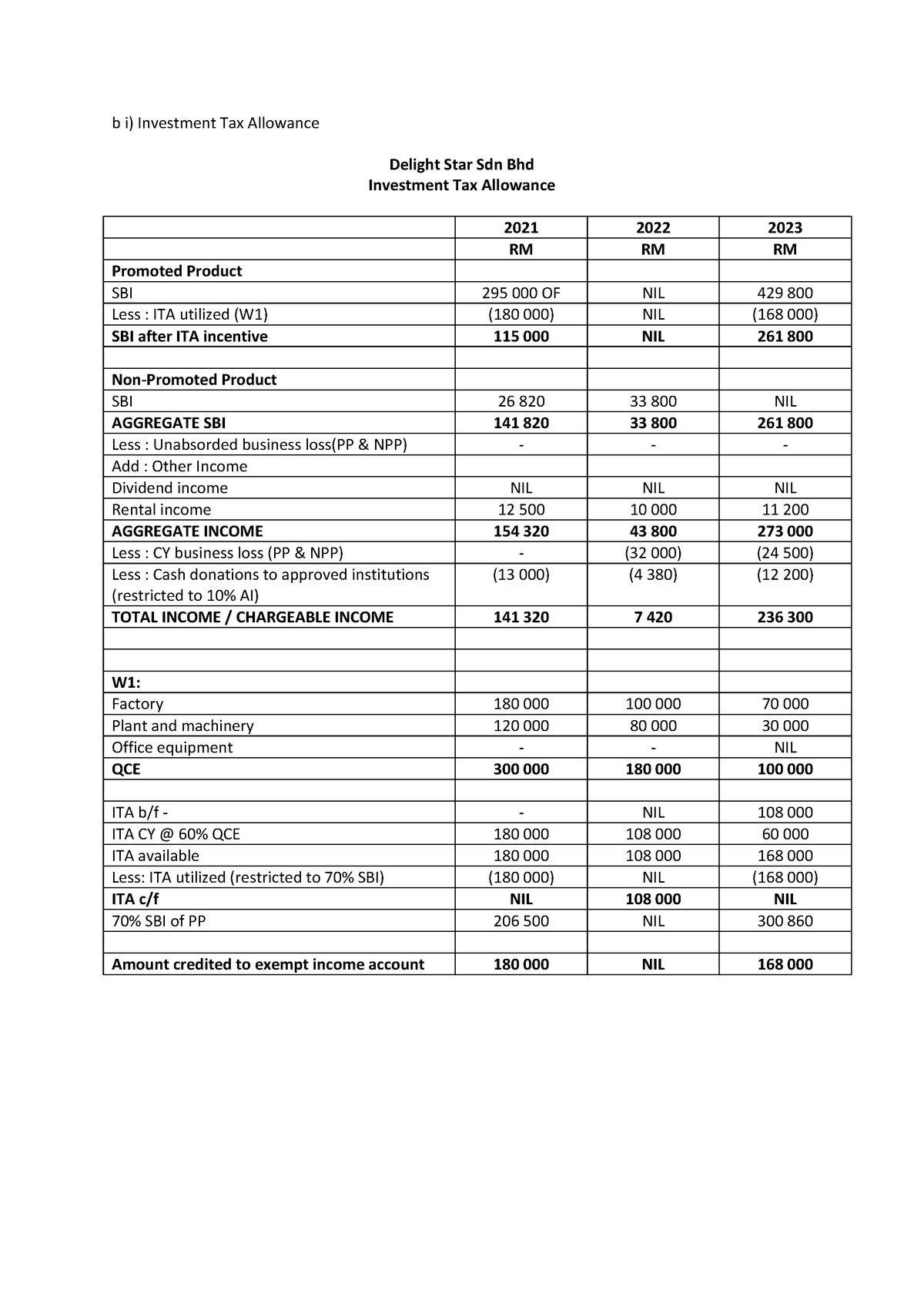

Tutorial 1 Investment Tax Allowance Ita Ra B I Investment Tax Allowance Delight Star Sdn Studocu

Do You Run Or Own A Green Penang Green Council Facebook

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

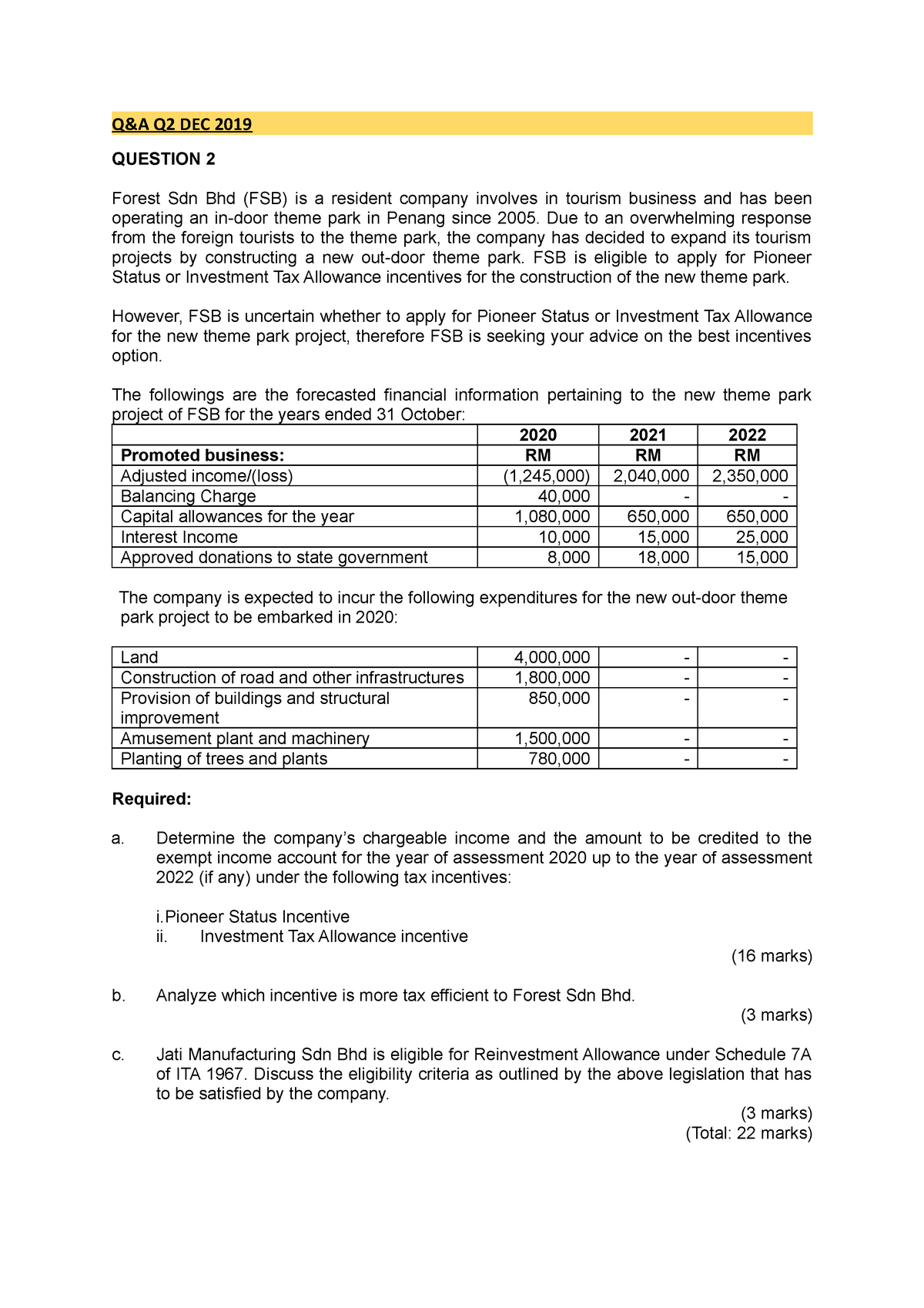

Q A Q2 Dec 2019 Q Amp A Q2 Dec 2019 Question 2 Forest Sdn Bhd Fsb Is A Resident Company Involves Studocu

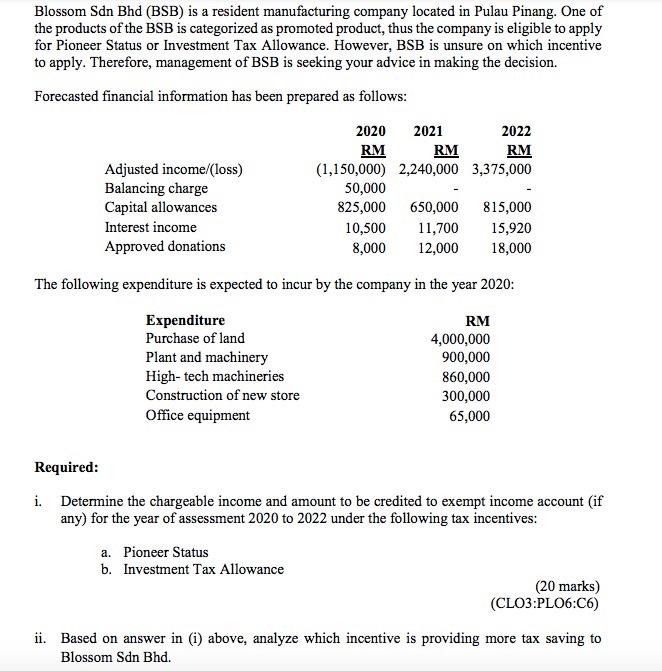

Solved Blossom Sdn Bhd Bsb Is A Resident Manufacturing Chegg Com

Malaysian Investment Development Authority 30 August 2016 Incentives And Grants Ppt Download

Ps Ita Ra Gr Ea Taxation 2 Pioneer Status Tax Incentives Allowance Pioneer Status Investment Studocu

Investment Business Opportunities In Malaysia Ppt Download

1 Incentives For The Aerospace Shipbuilding Shiprepairing Industries In Malaysia Malaysian Industrial Development Authority Ppt Download

Chapter 5 Investment Incentives

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global